Secure Your Lowest Life Insurance Rate

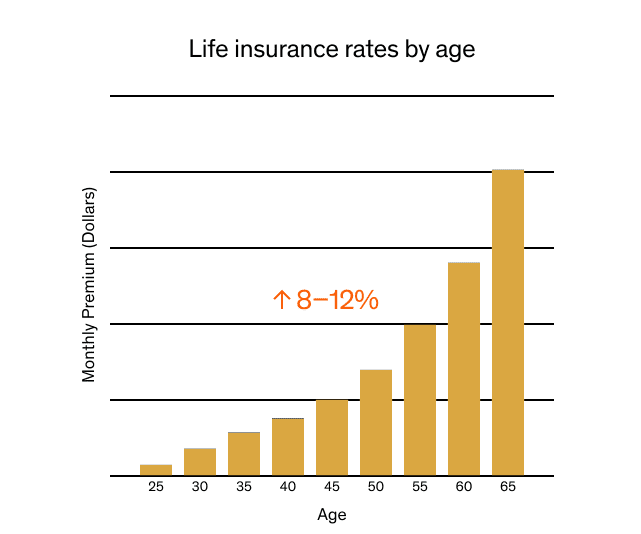

As you age, life insurance rates generally increase. Purchasing a policy sooner allows you to lock in a lower premium and save money over time.

A Simple Way to Save on Life Insurance Cost

Purchasing life insurance early often secures the best Term insurance rates. On average, life insurance costs can increase by 8% each year you delay. Once you sign your policy, your rate is locked in for the term.

For instance, a 40-year-old non-smoking male in good health could get a 20-year Term policy with $1 million coverage for $2,172 annually. If he waits until age 41, the cost rises to $2,340 per year, and $2,508 if he waits another year.

Rates generally increase with age, as shown in any Term life insurance rates by age chart.

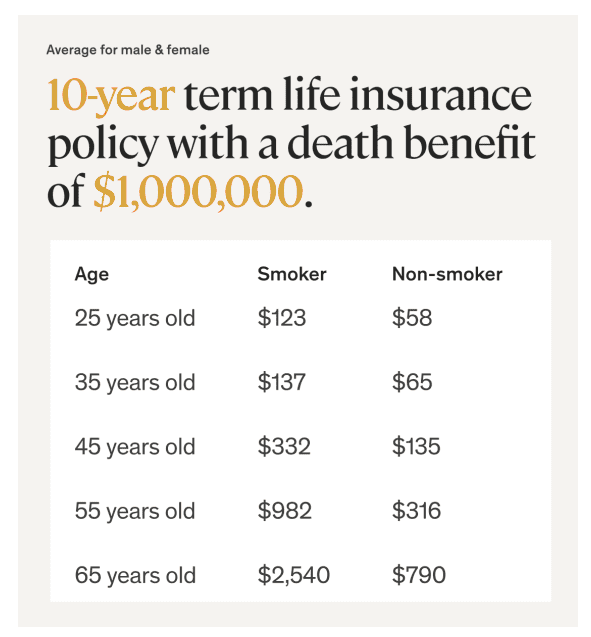

Average Term Life Insurance Rates By Age

Purchasing life insurance early often secures the best Term insurance rates. On average, life insurance costs can increase by 8% each year you delay. Once you sign your policy, your rate is locked in for the term.

For instance, a 40-year-old non-smoking male in good health could get a 20-year Term policy with $1 million coverage for $2,172 annually. If he waits until age 41, the cost rises to $2,340 per year, and $2,508 if he waits another year.

Rates generally increase with age, as shown in any Term life insurance rates by age chart.

Why Term Life Insurance Rates Are Lower For Younger People

Life insurance is typically less expensive for younger individuals due to several factors. Younger people are generally healthier and have a lower risk profile, which results in lower premiums.

This isn’t age discrimination but a matter of statistics. Insurance companies use actuarial tables and statistical models to estimate the likelihood of policyholders passing away during a specific period. These models consistently show that mortality rates are lower for younger age groups, which is why premiums are lower for them.

Common Mistakes When Buying Life Insurance

Waiting until you have kids:

Many people delay buying life insurance until they start a family, but waiting could mean missing out on locking in a lower premium. Even without children, life insurance can cover personal debts, medical bills, a home mortgage, lost wages, and funeral expenses, easing the financial burden on your partner or next of kin.

Assuming you’ll remain in good health:

Your health status is a major factor in determining life insurance rates. The healthier you are, the lower your premiums. As you age, the risk of developing health issues increases, potentially leading to higher premiums or difficulty obtaining coverage. Securing life insurance earlier protects you and your dependents against unexpected health changes.

Relying on employer-sponsored coverage:

While employer-provided life insurance is a valuable benefit, it often offers limited coverage—typically one to two times your annual salary, whereas experts recommend about 10 times your salary. Additionally, if your employment status changes—such as through retirement, layoff, or a job change—you may lose the policy.

If this happens when you’re older or have developed health issues, obtaining new coverage could be more expensive and challenging. Having your own policy ensures protection for you and your loved ones against life’s unexpected changes.

How to Get The Best Term Life Insurance Rates

How to get the best Term life insurance rates

Life insurance rates by age can vary significantly. While you can’t change your age, there are ways to potentially lower your Term life insurance costs:

Maintain good health: Health is a key factor in determining premiums. Individuals in good health typically qualify for lower rates. Address any existing health issues before applying for coverage.

Choose the right coverage amount and term length: Selecting a coverage amount that fits your needs and an appropriate term length can prevent overpaying for unnecessary coverage.

Quit smoking: Smoking increases premiums. By quitting, you may qualify for lower rates after a certain period of being smoke-free.